J.R. Kingsley Ward, Chair of DCM’s board of directors, will chair the Meeting. A brief management presentation and question and answer period will follow the formal portion of the Meeting.

Richard Kellam, President & CEO and James Lorimer, CFO

will host a conference call and webcast to present the Q2 2025 results followed by a live Q&A period.

Richard Kellam, President & CEO and James Lorimer, CFO

will host a conference call and webcast to present Q3 2025 results followed by a live Q&A period.

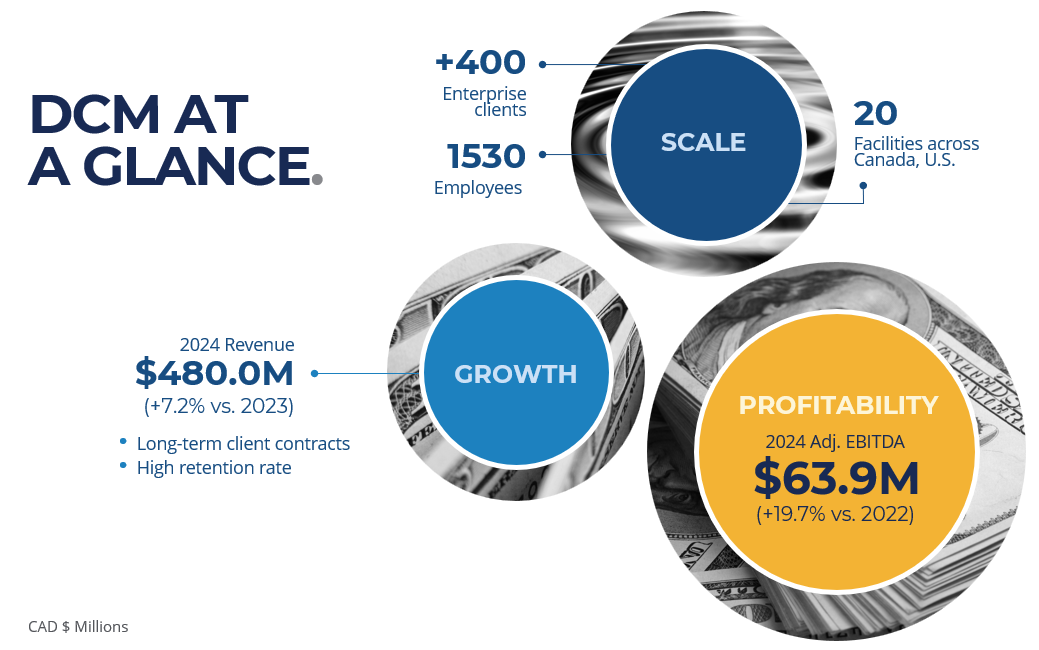

Corporate Overview

DCM is a leading Canadian tech-enabled provider of print and digital solutions that help simplify complex marketing communications and operations workflow. DCM serves over 2,500 clients including 70 of the 100 largest Canadian corporations and manages leading government agencies. Our core strength lies in delivering individualized services to our clients that simplify their communications, including customized printing, highly personalized marketing communications, campaign management, digital signage, and AI-driven social media marketing & digital asset management. From omnichannel marketing campaigns to large-scale print and digital workflows, our goal is to make complex tasks surprisingly simple, allowing our clients to focus on what they do best.

Why Invest

We are Canada’s 2nd largest Print & Marketing

Communications Company.

Many of our clients have been with us for 10+ years, and some for much longer. We continue to evolve and innovate to better serve their needs, offering solutions and support they can always rely on.

Our workflow and asset management solutions have significant (and increasing) penetration among our clients, with 8K users on a daily basis.

Many of our clients have been with us for 10+ years, and some for much longer. They know that we continue to evolve and innovate, providing them with solutions and support they can always rely on.

Q3 2025 by the Numbers

REVENUE

-3.1% vs. Q3 2024

GROSS PROFIT

-12.1% vs. Q3 2024

Gross Margin

vs. 25.8% last year

ADJUSTED EBITDA*

-2.1% vs. Q3 2024

ADJUSTED EBITDA* MARGIN

vs. 11.6% last year

NET DEBT* REDUCTION

to $80.6M since acquisition of MCC

*Adjusted EBITDA is a non-GAAP measure. For a reconciliation of Adjusted EBITDA to Net Income, see DCM’s MD&A filed on www.sedarplus.ca.

Latest Stock Information

(delayed 24:00 hr)

data communications mgmt corp

- Loading stock data...

| Capitalization | "DCM" on TSX |

|---|---|

| Recent share price (November 10, 2025) | $1.33 |

| 52 week high/low | $2.84/$1.25 |

| Common Share Outstanding | 54.9M |

| Options ($1.17 avg. price) | 3.9M |

| Fully Diluted Shares Outstanding | 58.9M |

| Market Capitalization (F.D.) | $83.7M |

| Total Enterprise Value* | $164.3M |

| TEV Including Lease Liabilities | $355.4M |

*Total enterprise value = market capitalization plus debt

Ownership Summary

(Fully diluted)

Latest Analyst Coverage

| Analyst | Firm | |

|---|---|---|

| Nick Corcoran | Acumen Capital Finance Partners Limited | [email protected] |

| Noel Atkinson, CFA | Clarus Securities Inc. | [email protected] |

| Daniel Rosenberg | Paradigm Capital Inc. | [email protected] |

Latest press releases

View all

DATA Communications Management Corp. Declares Quarterly Dividend of $0.025 per Common Share

Brampton, Ontario – November 11, 2025 – DATA Communications Management Corp. (TSX: DCM; OTCQX: DCMDF) (“DCM” or the “Company”), a leading Canadian provider of print

DATA COMMUNICATIONS MANAGEMENT CORP. REPORTS Q3 2025 FINANCIAL RESULTS

THIRD QUARTER 2025 SUMMARY Brampton, Ontario – November 11, 2025 – DATA Communications Management Corp. (TSX: DCM; OTCQX: DCMDF) (“DCM” or the “Company”), a leading